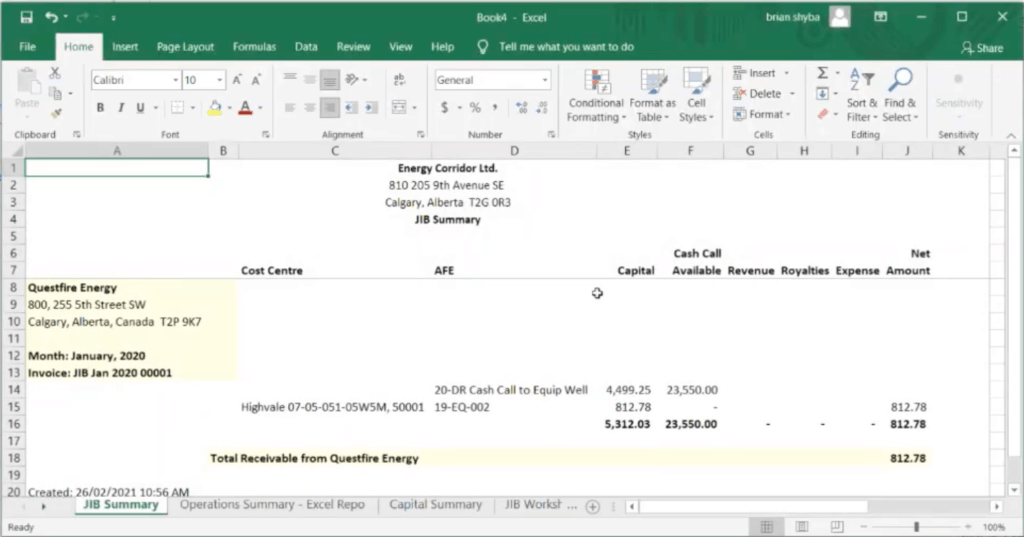

This post describes how to do bank deposits, using Energy Corridor—unified accounting software for oil and gas.

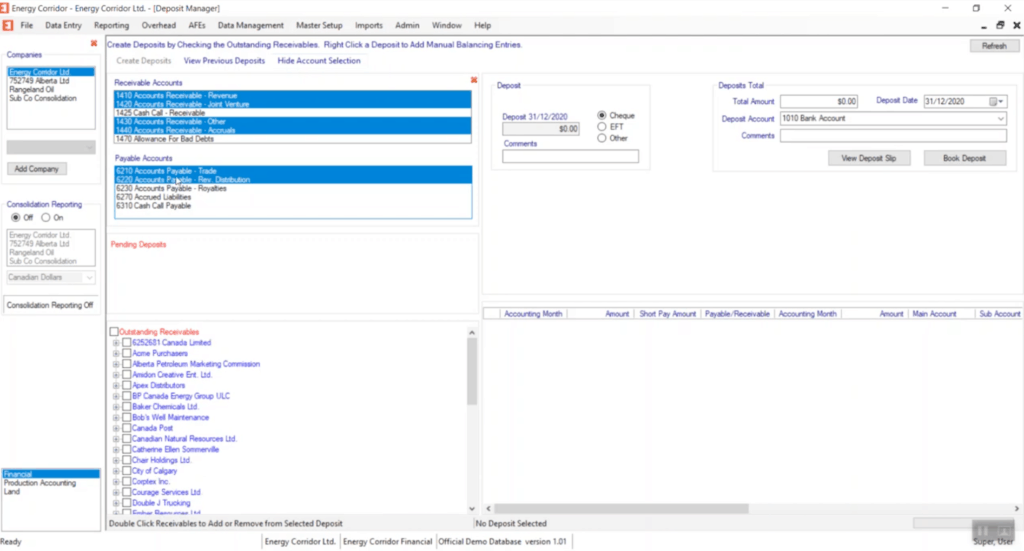

When you’re in regular deposit creation mode, you have pending bank deposits, which are the ones you’re creating, and your outstanding receivables that you can pick from.

The first thing you should do is set your deposit date. In this case it was a long time ago. We’ll make it December 31, 2020. You may have noticed that the outstanding receivables have increased, because we’ve moved forward in time, so we have more receivables to pick from.

The other thing that controls what receivables you see is your account selection. In this case, we only have two receivables accounts selected. Let’s pick a couple more. We may also want to see some payables accounts, just in case somebody has netted off some payables.

Now, usually your account selection doesn’t change that often, so it’s better probably to hide it so you have more space. Now we have quite a number of outstanding receivables to select from. You should also pick the bank account that you’re depositing to. You can add a comment for your bank deposit run, if you like. The total amount is calculated for you, and this is for each individual deposit.

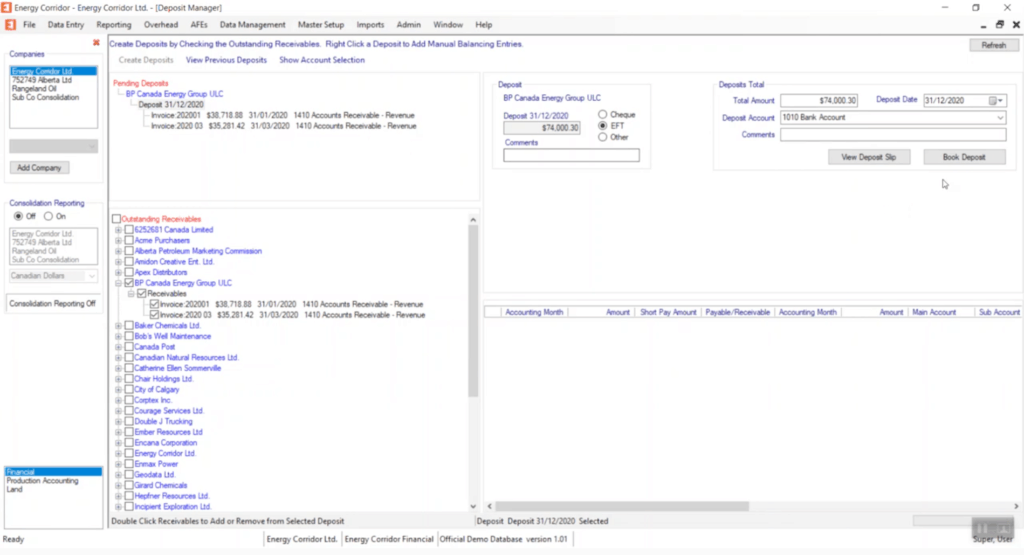

Let’s make a deposit. We’re going to do one for BP. We have a couple outstanding receivables, so we can pick them both.

Here’s our deposit for BP. We can say that it’s an EFT, if we like. In this case, it’s two receivables, so we’re just going to go ahead and create the deposit.

We could have viewed the deposit slip before, but here you’ll see the deposit slip when you book the deposit, and you can print it if you like. In this case we’re just going to go straight ahead and book it.

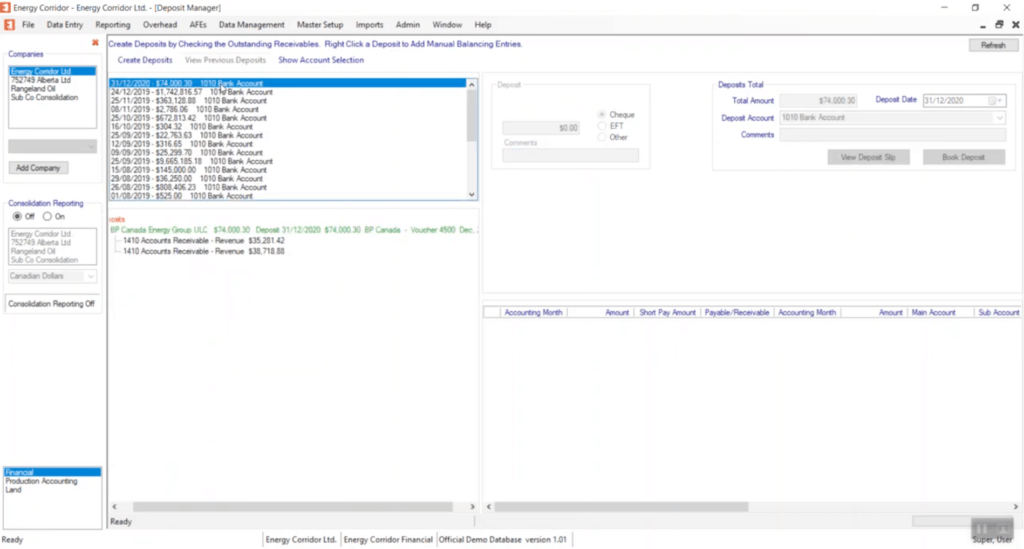

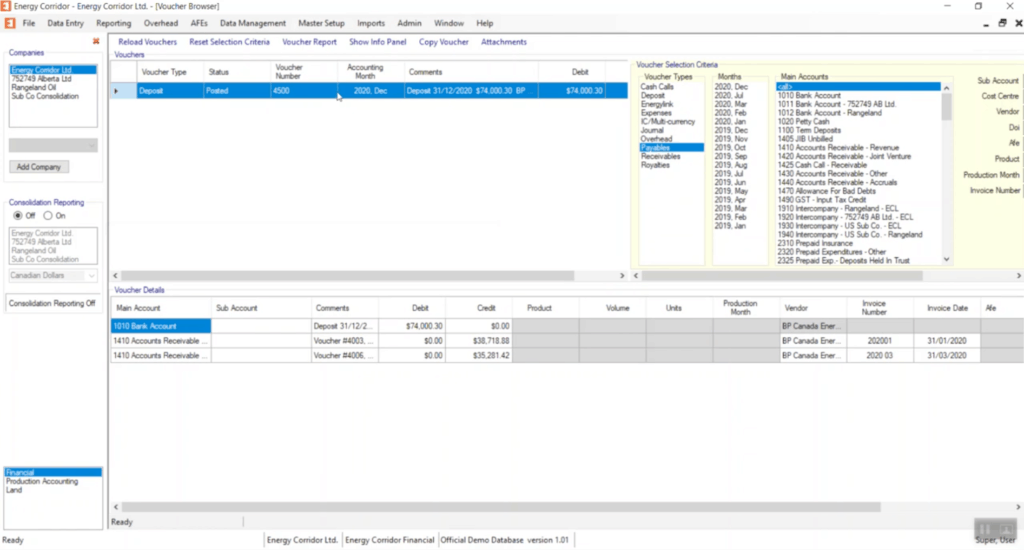

Now that you’ve made a deposit, you might want to go and see the deposit. You can view previous deposits. This is the deposit we just made.

Energy Corridor tells you what voucher it’s on and what date. It was created on Voucher 4500 for December 2020. Now, the voucher for deposits is created in the accounting month that the deposit is deposited on. This deposit date is important for that.

In this case, if we double-click the deposit, Energy Corridor will actually take us to the voucher viewer to see the voucher that was created for the deposit. If we look at the details, the two receivables, you can also double-click and it will take you to the receivable, the voucher that the receivable came in on.

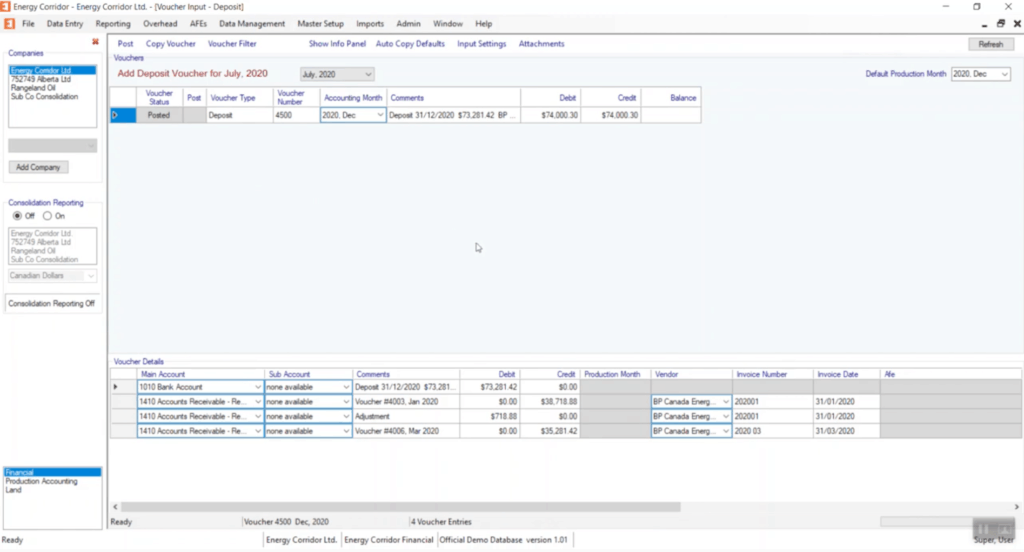

You can drill down to see what’s gone on. Let’s go back to creating deposits and look at the vouchers created in the deposit function, which are created as a voucher type: in this case, a deposit. We suggest you set up a voucher type for your deposits. Any voucher type can be used for deposits, but what you do is check off deposits and that will make the voucher type good for deposits.

You can only have one voucher type for deposits, or for overhead or any of the voucher types here. In this case, we’re going to go to our deposit vouchers and this is the voucher for BP. Now, I’ve decided that I made a mistake and they actually short paid us this $38,000 receivable. I’m going to roll back this voucher.

This is how you delete or remove a deposit you’ve made. You have to roll back the voucher and then delete it. Now, if we go back to the deposit manager you will see that BP’s receivables are again available.

Let’s do this again and correct it. On this one they short paid, so we’ll make that a short pay of $38,000. Then we’ll book the deposit.

Our $38,000 receivable has been credited, but then we have an adjustment for what was short paid.

Next, we’ll look at another situation, if you have to make an adjusting entry. We’ll pay this invoice from Bob’s Well Maintenance.

Now, for some reason they like to round things, so they rounded the payment from $28,612.54 to $28,613.00. What we need to do there, you select the deposit, right-click it, add balancing entry and we’re going to adjust it by 46 cents to make the deposit an even $28,613.00.

We’ll book this deposit. And you can see on this deposit, the 46 cent manual balancing entry to balance the voucher. And again, if you haven’t used the voucher in, well, usually it would be, you’ve reconciled the deposit, then you can roll it back, delete the voucher, and then the receivable and/or payables that you’ve used are again available.

That is how to do bank deposits in Energy Corridor.

Book a Demo

To learn more about Energy Corridor, contact us for a demo.