Bank Reconciliation

This post and video tell you how to perform a bank reconciliation using Energy Corridor, the oil and gas accounting application.

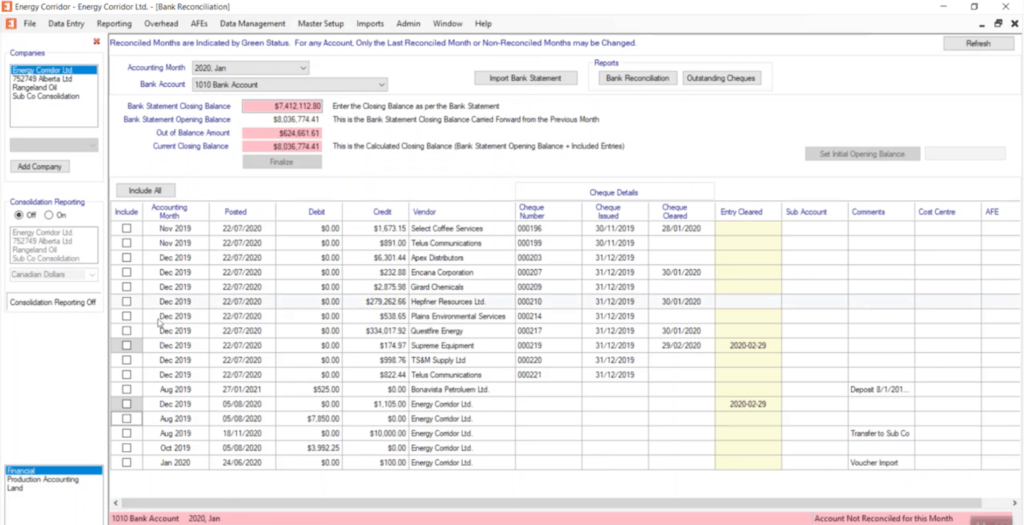

We’re in the bank reconciliation screen. And right now we have a reconciled month for account 1010. You can see when an account is reconciled, it’s green. It also says in the bottom right-hand corner that the account is locked for this month.

An account is reconciled when you have included all of the items that are on your bank statement and you’ve input your bank statement closing balance, and your opening, plus all of the items you’ve included, equals your closing.

We’re going to do the bank reconciliation for January. Right now we have not included anything. We’re going to put in the closing balance as per our bank statement. You’ll notice that Energy Corridor gives us our out of balance amount. So what we do is include items until this out of balance is zero, and then we’ll be reconciled.

One thing you’ll notice is that some items are grayed out. A grayed out item, if we try and check it, will tell us it’s reconciled in a future month. If we look at February, we’ll see that someone has reconciled to it items for February. They know that they’re part of the February bank statement. You’ll also notice you get a warning that you’re not in the next month to reconcile and that January of 2020 still needs to be done.

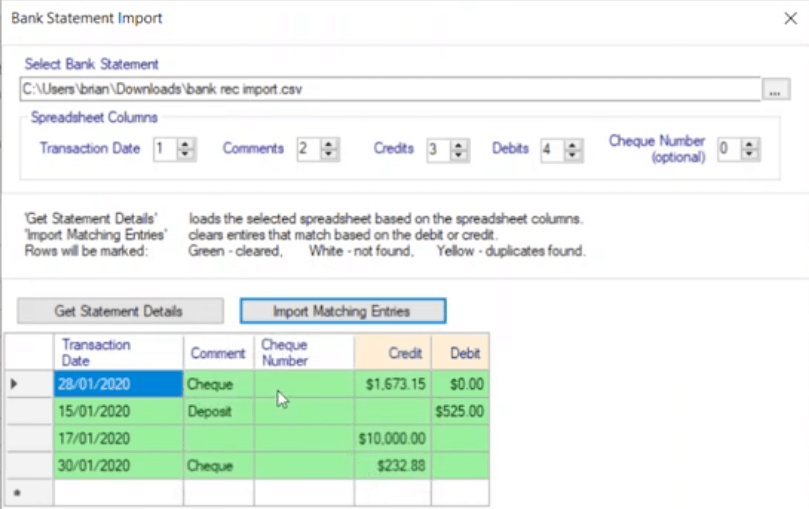

Let’s go back to January. The first thing you’ll do is import your bank statement. All banks will supply a CSV file of your bank statement. If you select it —and you only have to do this once — you tell Energy Corridor the format of the statement by specifying which columns, debits, credits, comments, and the transaction data in and optionally the cheque number. Once you’ve done that, you can get your statement details. We’ll read the statement and import matching entries.

In this case, it’s matched all four entries. It matches based on the entry amount and optionally the cheque number. You can have more than one entry with the same amount. And in that case, it does not include them automatically. It marks them with yellow, and you’ll have to include those manually.

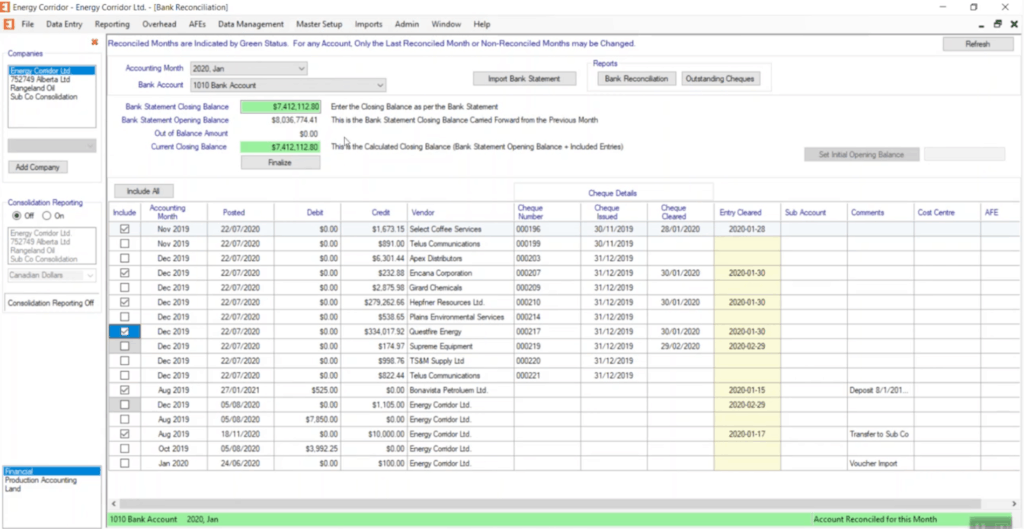

You can see that our four items have been included from the bank statement. Now, in theory, once you’ve done that, if all items were included from the bank statement and you’ve input your bank statement closing balance correctly, you should be reconciled.

In this case, we didn’t have it do that. When you include an item in the reconciliation, Energy Corridor clears the cheque as of the transaction date in the file. It also clears the entry. If the entry is not a cheque, it just clears it as of that date. But in this case, to reconcile this account, we have to include two more entries. You can see that they’re also cheques and now we’re reconciled. Our out of balance amount is zero.

Now, the entries that have been included, plus the opening balance, equals our closing balance. We can finalize this month, and we can also do our report. The bank reconciliation report shows the account for the month, shows the opening balance, withdrawals, deposits, withdrawals outstanding, the closing balance, and the matching ledger amount.

We can also see outstanding checks for the account. You’ll notice that you can set an initial opening balance that would only be used on your very first month. We also have an option to include all entries. So if you do have many, many entries, you can include them all and then start unchecking them if you want to do it that way.

That’s how to do a bank reconciliation in Energy Corridor. One other thing worth noting is that clients often have difficulty when they’re trying to roll back a deposit. When they try to roll it back, they see a message that it’s been used. Nine times out of ten, that means is that it has already been used in the bank reconciliation. We’ll go to February to see if the item is a deposit. It’s been included, you can’t roll it back. So come to your bank reconciliation, uncheck it, and you will be able to roll back your deposit. Of course, if you included it in a month that’s been reconciled, that deposit is done.

That’s how you do your bank reconciliation in Energy Corridor. Don’t you wish it was always that easy?

Book a Demo

To learn more about Energy Corridor, contact us for a demo.